Nick Plumb

Director of Policy and Insight

For anyone following politics, stability isn’t one of the words we’d use to characterise the last few years. Indeed, the only constant during this period has been persistent and ongoing volatility. Most recently, we’ve seen this manifest in Reform UK’s gains in last month’s local elections, and their ongoing strong performance in the opinion polls.

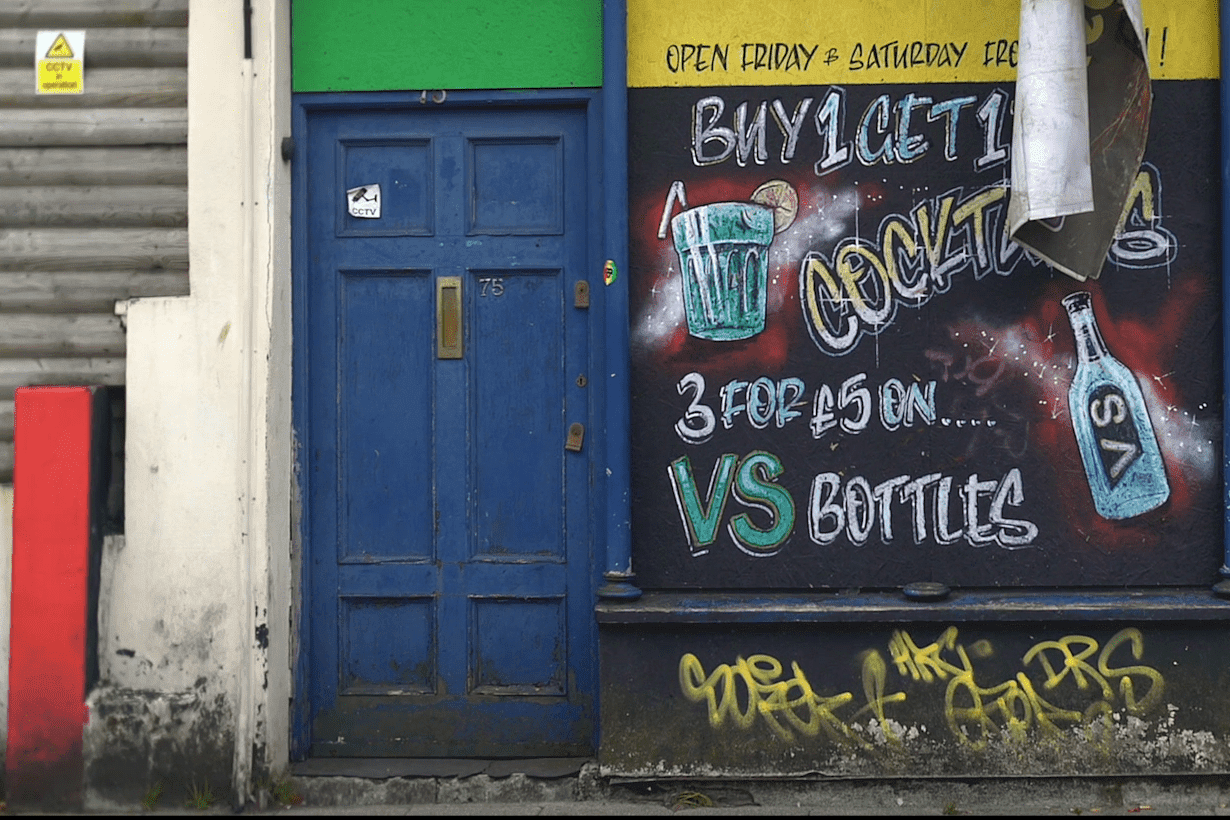

At the same time, many communities have experienced this political instability alongside economic decline or stagnation. This is often most visible in the state of local town centres and high streets.

So, if people aren’t seeing and feeling positive change, most symbolically on their high streets and in their town centres, could this explain the increased support for newer, challenger political parties like Reform UK?

Our latest report revisits our 2023 High Street Warning Lights research to dig into this. We find that support for Reform UK is rising in places with declining high streets, predominantly in the Midlands and Northern England. This is part of a wider trend we’ve seen where the health of our high streets has an impact on our elections.

A growing body of evidence

In our Community-powered high streets paper from 2023, we identified 100 ‘High Street Warning Lights’ – locations that saw the most significant increase in persistent high street vacancy between 2015 and 2023. We identified 46 of these as places of significant interest for the general election because of their electoral marginality ( with majorities less than 10,000). This now seems a little misguided – we saw huge shifts in these places at the 2024 general election, including a 25,000 majority overturned with Richard Tice’s win in Boston and Skegness.

New academic research has drawn a connection between visible local decline (particularly on the high street) and support for the UK Independence Party (UKIP). Carried out by Prashant Garg, Jacob Edenhofer and Thiemo Fetzer, the publication covers the period 2009 and 2019. Researchers find a significant association between high street vacancy and support for UKIP. This research builds on other academic work exploring the decline of social infrastructure and support for right-wing populist parties. Diane Bolet’s work in 2021 saw this same relationship play out in relation to pub closures across the UK.

No greater volatility in the High Street Warning Lights

The recent local election results showed UKIP’s spiritual successor, Reform UK, performing strongly across swathes of the country. We want to see if, hidden in this persistent vacancy data, there are any clues to the dynamic of some of these places when the next general election comes around. The High Street Warning Lights are represented by 94 parliamentary constituencies following the 2023 boundary review.

Academics like Rob Ford have reflected on the increasing political volatility at length. So, is there any greater volatility in the High Street Warning Lights areas? Forty nine (52%) of the constituencies that represent the High Street Warning Lights areas changed hands at the 2024 General Election, compared with 44% in the rest of England. However, this does not represent a statistically significant difference, so seats which have experienced the greatest increase in persistent high street vacancy do not appear to be more changeable than the rest of England.

High street decline is a likely factor in Reform’s 2024 electoral gains

While political volatility isn’t a factor in these areas, our analysis suggests that Reform are overperforming in places suffering high street decline. We use Reform finishing second in 2024 as the proxy for electoral success. Indeed, with Reform in second place in 85 constituencies across the England, this provides them a potential springboard to further success at the next General Election.

Reform is the second party in 23 parliamentary seats (24%) across the High Street Warning Lights, compared to 62 (14%) across the rest of England. This does represent a statistically significant difference between the proportion of second place finishes in the areas where persistent high street vacancy was increasing prior to the election when compared to the rest of England, suggesting that Reform performed better in areas of England with struggling high streets.

Recent local election results suggest Reform could make even bigger gains in these places

How do the recent local election results bring this analysis further up to date? This is where it gets interesting. If we use recent local election gains as a further proxy for Reform’s chances in these 100 places, a much higher proportion of the High Street Warming Light constituencies would see Reform as the main challenger.

Forty four of the 100 locations on the list (covering 39 constituencies) saw Reform come in first or second place at the 2024 general election or win a majority or minority in county council elections in 2025. Four MPs (three Labour, one Conservative) now have a Reform-controlled council in their area. Thirty three of the seats were won or held by Labour, five are Conservative-held, and one (Great Yarmouth) was won by Reform in 2024.

This layer of analysis comes with three key caveats. First, we don’t have local election results for every place (whether they’re a part of the High Street Warning Lights or not), so we can’t compare local election results with the wider English sample as we can for the 2024 results. Secondly, this big jump could be seen as broadly reflective of the jump we’ve seen in Reform’s polling in recent months. It’s not necessarily high street decline that is behind these additional seats coming into play.

However, we can conclude from this analysis that Reform’s vote share is stronger in places suffering high street decline. Combined with recent local election results in these places, and Reform’s consistent high performance in national public opinion polls, this Shuttered Front could be a key electoral background at the next general election.

What should parties contesting the electoral background do?

As we’ve long argued, high streets are a key barometer for the way people feel about a place, and indeed the wider economy. It’s no wonder there is an association between the state of the high street and people’s electoral choices. Combine this with the fact that 84% of people feel they have little or no control over the decisions that affect their lives, and we believe there is one central solution: Government and other political parties seeking to contest this battleground should explore community-led high street renewal policies.

We’re actively testing this in places in places across the country, including Stockport, one of the places that appears in the Shuttered Front. We look forward to sharing more from our work in these places soon.

For a government looking to respond to the rising popularity of Reform and take steps to meaningfully and visibly improve the state of the high street, we believe our Civic High Streets Accelerator would be a good place to start. It would bring together a package of new powers, funding and support to enable community-led high street transformation. This package would include:

- Powers to purchase and transform local high street assets, including through the Community Right to Buy.

- Funding for community-led transformation, through a successor to the Community Ownership Fund, as well as through existing schemes like the Plan for Neighbourhoods and future local growth funds.

- Access to expert support for community-led regeneration, building on the expert advice provided by the High Street Taskforce with expertise in community-led high street regeneration and advice on exercising new powers such as the Community Right to Buy.

- Opportunities for community-led governance, building on insights from initiatives like Power to Change’s Community Improvement District pilots and ongoing Community-Led High Street Innovators work.

- Support to boost communities’ local economic contribution, explicitly aiming to increase community ownership of high street assets to drive regeneration and keep money in the local economy, working with community business.